Impeccable Timing and Knowledge Separate the Stock Trading Elite

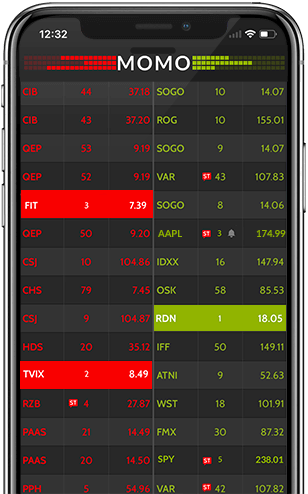

Purposeful interface with real-time stock streaming make MOMO your must have companion whether on the go or at the desk

Track bullish to bearish momentum swings across indices with MOMO Meters in real-time.

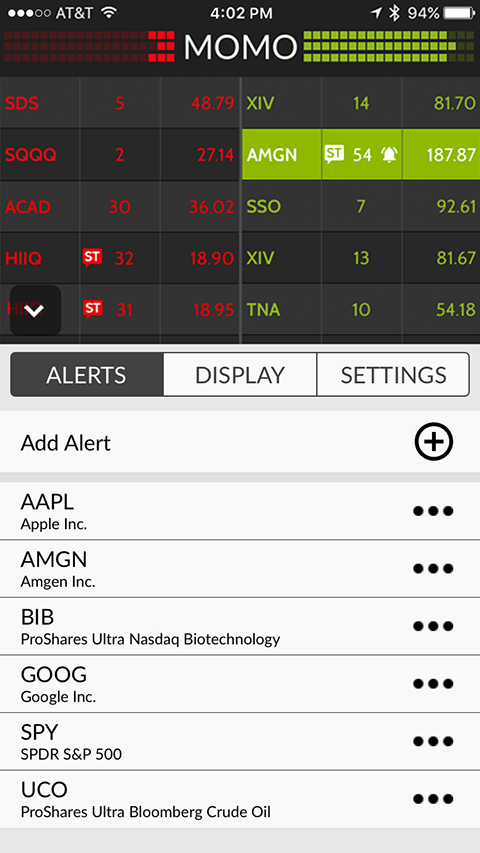

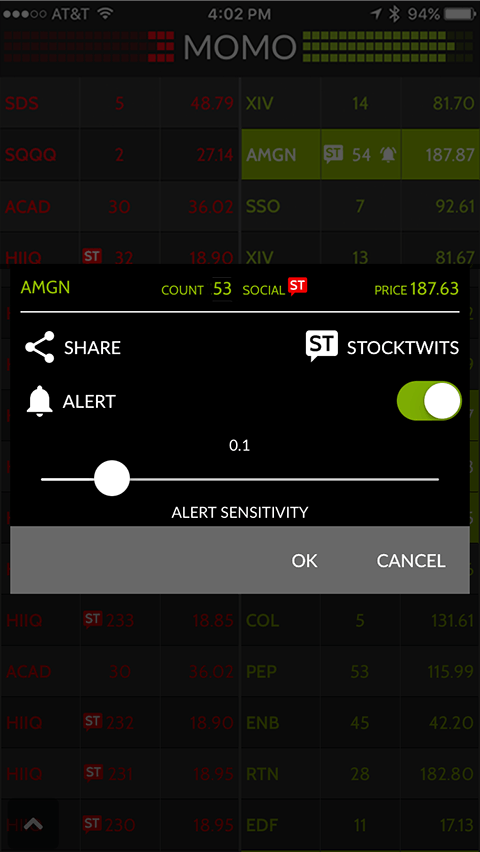

Display real-time highs and lows for desired market and get stock alerts via push notification or in-app alert.

Intuitive visual indicators quickly highlight breakouts, social network activity, and momentum strength.

Share breakout stocks in seconds with iMessage, Twitter, and StockTwits.

MOMO evaluates over 7000 stocks from Nasdaq, NYSE, and AMEX in real-time to deliver a live stream of stocks making new daily highs and lows directly to your mobile device.

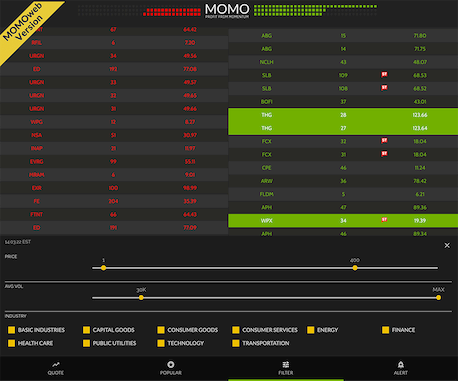

Get MOMO from the App Store for iOS or Google Play for Android. Or, simply sign up for our browser version - MOMOweb.

Launch and go. Once launched, MOMO instantly begins streaming daily highs & lows.

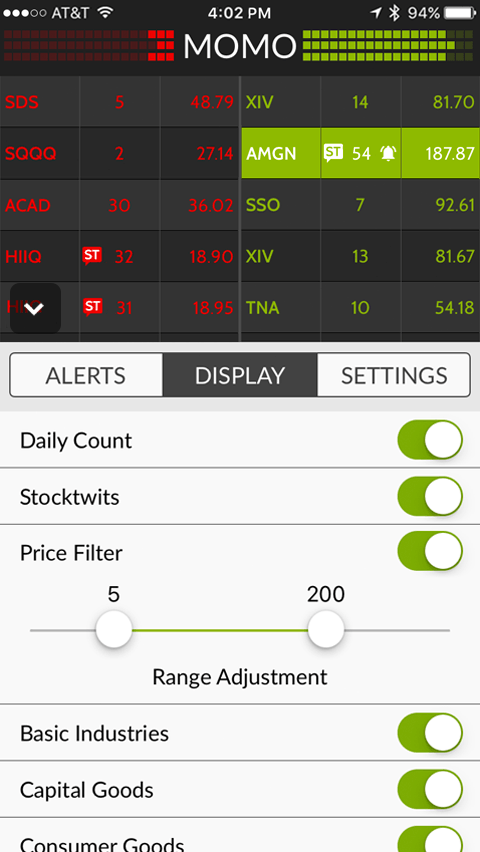

Suit it to your needs and trading style - set layout, alerts, and filters.

This highly regulated statement probably requires an asterisk. We will say... being first to the party is always preferred.

MOMO nor Mometic LLC make no recommendations whether to buy, sell or take any action based on the data we present. MOMO is intended for experienced traders and investors who realize trading can cause significant or catastrophic losses if not used properly. Mometic LLC, its employees, nor any of its affiliates take any responsibility for gains or losses realized from the use of MOMO.

Highly optimized for uncovering breakouts; if only all stock apps were designed with purpose.

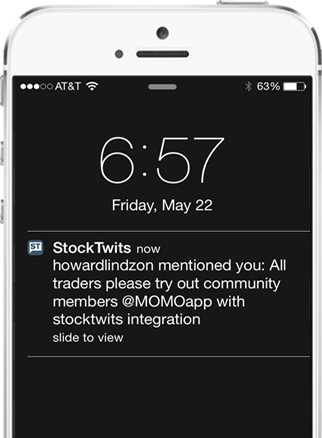

Howard Lindzon, the founder of StockTwits and investor in Robinhood recently gave MOMO the best endorsement and StockTwits Tweet we could ask for. (We have no business relationship with StockTwits. We only have integrated StockTwits API)

"Really good idea....I will totally use this"

— Howard Lindzon

MOMO is designed to be a low friction experience. You can use MOMO every day for up to five minutes at no cost. If you find MOMO works for you, you may subscribe for unlimited use.

Just remember... While we believe timing and knowledge are critical for successful trades and engineered MOMO to deliver, we cannot guarantee your profits.

Scan through our FAQ to learn more about using MOMO to uncover stock trading opportunities.

MOMO currently scans all stock symbols in the Nasdaq, NYSE, and Amex (now NYSE Mkt). We currently include over 7000 symbols. If you would like to confirm that a symbol is available, the easiest way is to try adding the symbol as a MOMO stock alert. Alternatively, you are welcome to contact us below and ask.

Yes! Extended hours support was a big reason for building MOMO. We felt having pre-market and after-hours visibility on our phones and tablets would provide us with a lot more freedom and awareness (especially during earnings season).

Sure. "Real-time" is overused in the financial sector since it sounds better than "almost real-time". In any case, MOMO receives the feed in real-time, introduces less than 10ms of processing latency, then streams to your mobile device. That said, in periods of high momentum where numerous stocks are breaking out to new highs or lows, MOMO queues the stocks so they can be viewed as opposed to streaming them in an illegible blur. This may introduce up to 15 seconds of delay, but is still generally faster than most online real-time trading platforms, charting apps and watch lists.

We initially designed MOMO for phones and tablets, but quickly came to learn many of you wanted MOMO also on your desktop, so we built MOMOweb. MOMOweb is primarily designed for your desktop, but can also stream to any browser-enabled mobile device. MOMOweb includes a few new features and a desktop-friendly layout. Additional features include; quotes, additional news services, alert history, and a popular stocks view. MOMOweb also includes browser alert notifications, which work particularly well with Chrome on both desktop and mobile. We are very excited about MOMOweb and particularly think the popular stocks view will help you uncover new opportuntities by seeing what stocks other MOMO users are visiting.

We aren't big on reviews, but since you've read this far, here are a few exchanges with MOMO users. These are unsolicited reviews and general feedback we captured via emails, chat support, or social media. We welcome the chance to add your review as well - even better is a story about your winning trade with MOMO.

REVIEWS:

Hey! You're on to a real winner here, great job. I'm not sure what kind of setup you've got going on, but if you're in the market for co-founder, we should definitely talk. Here's some of my work (I'm a trader but also an Android developer)

Thanks for the follow here. I have a verified Google+ personal account and Twitter account I will mention the simple use (a stock screener, but with social media & cumulation mentioned = novel tool) and already subscription paid for itself. Cheers.

Brent [4:43 PM] Hi Steve How is MOMO working for you overseas? Steve [4:43 PM] That's OK Brent, was starting to love the app the it broke lol...well, I broke it loading IOS9 Brent [4:43 PM] I imagine realtime US data is hard to come by. Steve [4:44 PM] Works great. I trade a schwab account so US markets. Would love to see a LSE version... Brent [4:44 PM] We tried to notify everyone about our pending ios9 compatibility fix with in-app notifications Steve [4:45 PM] I have live US feeds through my schwab account (streetsmart edge platform Brent [4:45 PM] People also want futures and commodities. Steve [4:45 PM] Can understand that, I tend to spread those. Brent [4:46 PM] Yes. I dont really trade them, but seeing them in extended hours could be useful Steve [4:47] Sounds good. Thanks for help.

Hey, awesome job with MOMO! I'd love to get a bit more comfortable with the app before plunking down the subscription fee. I'm a new trader and want to see how useful it is with RobiHood. I saw you had offered beta trials last month to users, but not sure if it is still running. The 5 minutes are helpful to get an idea of how it could work, but I'd love to see how it will actually work for me if possible. Thanks and no big deal if not, I'll probably just subscribe either way. Really cool app, love the interface! Best, Alex

My title would sound fake if I was honest by david******** Simple. I have written only a few reviews, and I don't do so lightly. As a disclaimer, the developer has communicated with me to inform me of updates for the new iOS9 update. However, that does not bias my review but should inform the consumer the dedication invested for updating and creating his app. Most importantly, it simplifies identifying stocks that are trending in price (from sectors you can select also including updates pushed to your phone for select stocks.) For me it was simple. I remember a stock passing by and it was obviously hot and I opened it up with my software, quickly noticed a key indicator of performance for this sector, and purchased at that moment. I was in early, and the payout was more than this software will cost me for a lifetime (if I want to consider additional gains on this same stock and attribute it to the software that brought it to my attention.) Will it make you first at the gate every time? Is it always best to be first to follow a trend? No, but I would like to know as it occurs so I can decide for myself. I am happy to start using it on the new iOS and set my alerts to track a few stocks I want updates on before trading hours. This includes mentions in social media, price changes and following the Twitter account will also help with a few of the key updates. Can you do it yourself? With hours of coding into your trade station alert system or a cloud computing data analytics of your own or just try the app. It is 6:00 AM, and I have it on while I work on other computer tasks. It doesn't replace your charting & trading software, but unobtrusively eases and works along side them.

Name: Stephan Hi, My name is Stephan and we met at Stocktoberfest a couple days ago. I really like the app and I purchased the monthly subscription. I would really like to see a few basic features added to the app such as filtering out stocks by price (I don't want to see stock below $2), filter by avg volume, current volume, and relative volume. The reason is because sometimes the app shows stocks that I not want to trade. For example, SFST just popped up on the new high list but it's only traded 759 shares so far today and the average volume is only 4.17 thousand shares. I would be a life long subscriber if you could get those basic filters on the app. Overall, the experience is great and I love the app. Thanks, Stephan

Hi Brent, I can see about a pic. But again, happy to give you a floor tour if you are ever in NYC. Following your other point, do you ever plan to do payment for order flow with zero-commission trading, a la Robinhood? I imagine this might be interesting if you could actually trade momentum from the app. I know many people who would be interested in something like that. Especially if you expand into other techincal indicators... Cameron

Got it. Man this app is groundbreaking. I love it. Currently watching FXCM go nutso. I am so appreciative! I am going to be locking in the year-long subscription very soon. For someone just starting on trading, this is a godsend. Thanks!!!! Josh

I love the product ! I benefit everyday from it. Ok thanks for the help! I still want all the stocks to show maybe a way to highlight a certain price. Tom

Hey Brent, Thanks for getting back with me. I'm a moron-five minutes after I emailed you I found all the answers right there on the blog! Anyway, upgrading tomorrow when I return home. Your app is unique and a bargain to have that info organized and disseminated for your subscribers. Thanks again, Richard PS I'm telling all the guys/gals on our enhancedinvestor.com team about your app tomorrow night.

Hi Brent, thank you very much for your answer! I'm thrilled to try it, really! :) I saw MoMo on a friend's iPhone and I loved it! :) Thank you very much again and I wish you a big success! Have a nice day, Dario

Stocks upward and downward movements, by nature, are never continually rising or falling. They periodically enter holding patterns where they move "sideways" in a tight trading range with little volatility. Those active in the stock market want to identify those stocks that break out of this trend as quickly as possible.

By focusing on stocks with momentum and ignoring others, you can keep a broader eye on the market. MOMO delivers instantaneous, real-time insight on stocks with momentum, so you can quickly find breakouts and determine whether or not to trade or invest before others.

Still looking for more info? Check us out on Facebook, Twitter, or StockTwits. You may also be interested in a MOMO review from another professional trader's perspective.

We are a small team of developers and traders who thrive on challenges and building products. We've built businesses, architected SaaS systems for the finance market (ask us about parsing CUSIPS and calculating BEY if you dare), regularly trade complex stock instruments, and now build stock apps that serve our needs and hopefully yours.

We welcome your suggestions, questions, and even the occasional gripe.